[ad_1]

U.S. consumers are not adopting voice-dependent buying as immediately as anticipated, in accordance to a new report currently from eMarketer. When buyers have been delighted to carry wise speakers into their house, they continue on to use them extra usually for uncomplicated instructions — like participating in audio or having data, for case in point — not for building purchases. On the other hand, the overall selection of voice purchasers is increasing. It is just slower than previously forecast, the analysts reveal.

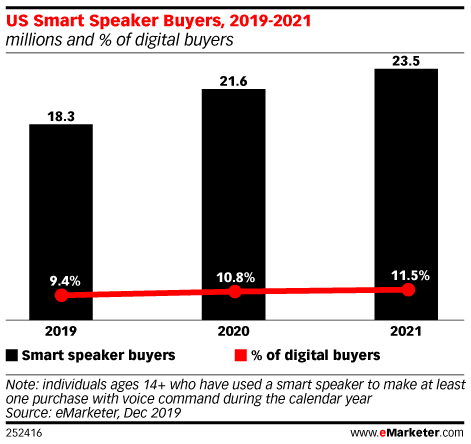

By the conclude of this calendar year, eMarketer estimates that 21.6 million individuals will have made a acquire utilizing their intelligent speaker. Which is lessen than the Q2 2019 forecast, which envisioned the number to achieve 23.6 million.

Nonetheless, it’s significant to level out that the overall selection of persons creating buys by means of a sensible speaker is developing. It will even move a milestone this 12 months, when 10.8% of all digital buyers in the U.S. will have manufactured a obtain applying their wise speaker.

EMarketer characteristics the slower-than-predicted advancement to a range of components, like that safety considerations are main people to not nevertheless thoroughly trust intelligent speakers and their makers. Numerous buyers would also want a gadget with a monitor so they could preview the goods ahead of committing to buy. Apple and Google have dealt with the latter by introducing good property hubs that consist of screens, speakers and created-in voice assistants. But buyers could have previously purchased regular Echo and Google Residence gadgets and do not come to feel the require to up grade.

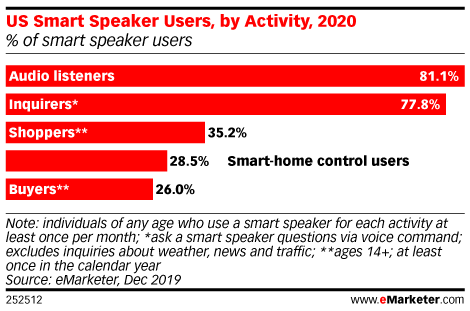

In addition, the report upped the estimates for share of people listening to audio (81.1%) or earning inquiries (77.8%).

“Though there are hundreds of good speaker applications that do every thing from allow you purchase takeout to uncover recipes or participate in games, numerous people don’t recognize that they will need to acquire excess and much more distinct methods to employ all capabilities,” explained eMarketer principal analyst Victoria Petrock. “Instead, they adhere with immediate commands to enjoy audio, question about the weather conditions or request thoughts, mainly because these are primary to the product.”

To be fair, a forecast like this just can’t give a complete photo of smart speaker utilization. Many consumers do check with Alexa to incorporate items to a purchasing list, for occasion, which they then go on to get on-line at some issue — but that would not be regarded voice-centered purchasing. In its place, the smart speaker sits as the leading of the funnel, capturing a consumer’s intention to invest in later on, but does not cause the actual invest in.

That said, Amazon, in distinct, has unsuccessful to capitalize on the likely for voice searching, given how effortlessly it can tie a voice command to a obtain from its internet site. Most likely it grew to become a tiny gun-shy from all these mistaken purchases, but the business hasn’t innovated on voice browsing options. There are a range of approaches Amazon could make voice purchasing a habit or convert 1-time buys into subscriptions, just by way of simple prompts.

Amazon could also create a established of capabilities, identical to Honey (now owned by PayPal), that let buyers monitor price tag drops and gross sales, then notify Echo homeowners using Alexa’s notifications platform or even an “Amazon companion” talent, that could be extra to users’ each day Flash Briefings (e.g. “The merchandise you ended up seeing is now $50 off. The new price tag is…$X…would you like to invest in it?”). The companion could also observe out-of-stock items, notify you to new arrivals from a favourite brand name, or even deliver item photos to the Alexa companion app, as proposed offers.

As an alternative, Alexa voice shopping stays fairly primary. With no advancements, customers will very likely continue on to keep away from the alternative.

EMarketer also nowadays adjusted its forecast for over-all good speaker usage. As an alternative of the 84.5 million U.S. good speaker buyers, the 2020 estimate has been dropped to 83.1 million customers, indicating a bit slower adoption.

[ad_2]

Resource hyperlink